PayTo marketing kit

This marketing kit is designed to help businesses communicate PayTo to their customers.

Download and/ or use of the PayTo Trade Marks will be deemed acceptance of the Terms and Conditions of Use:

Wordmark

Using the PayTo wordmark

The PayTo wordmark is designed to be clear and intuitive, helping to reflect the service and guide users through the PayTo customer journey.

Designed with flexibility and function in mind, the wordmark can work across multiple channels and applications. PayTo has been designed to complement, rather than compete with, other brands and services. The wordmark sits seamlessly alongside financial institutions’ products and on a merchant’s website or payment screen. Where not practical to use the wordmark due to space limitations or technological constraints, a symbol and a text-only mark may be used as alternatives to signify the PayTo identity, subject to the conditions noted below.

Symbol

Using the PayTo symbol

The symbol should only ever be used in small spaces, such as mobile or in-app, where the full version of the wordmark has already appeared earlier in the customer journey.

For clarity and consistency, it is recommended that the full name (Pay To) should still appear in the same visual field as the standalone symbol.

Text only mark

The text only mark should only be used when use of the wordmark and symbol are not feasible. The text only mark should only be used when familiarity with the PayTo identity has been established.

When using the text-only mark, PayTo should always appear as one word with both a capital ‘P’ and ‘T’. Situations where you might need to use the text-only mark include text-only displays, when writing copy, or on a button.

Trademark wording

If using the PayTo wordmark:

The ® symbol

The trademark symbol ‘®’, must be applied with the first or most prominent mention of PayTo in body copy and in superscript format.

Footnote

The footer to the trademark must include the following, or the following must be shown below written copy if you aren’t using assets that include the footer:

“PayTo is a registered trademark of NPP Australia Limited.”

If using the PayTo AND PayID wordmarks together:

The ® symbol

The trademark symbol ‘®’, must be applied with the first or most prominent mention of PayTo and PayID in body copy and in superscript format.

Footnote

The footer to the trademark must include the following, or the following must be shown below written copy if you aren’t using assets that include the footer:

“PayID and PayTo are registered trademarks of NPP Australia Limited.”

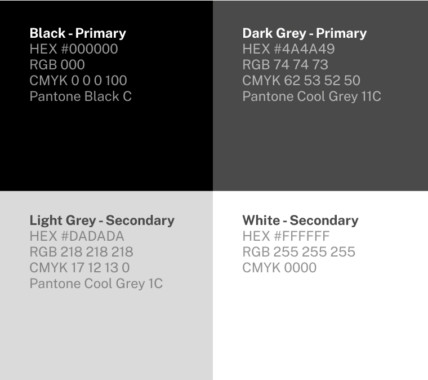

Primary colour palette

The reproduction of colour is a key factor in ensuring consistency of the PayTo identity.

Please ensure the correct colours are used for the relevant application. For example, CMYK and Pantone are used for Print. HEX and RGB are used for digital applications. Legibility and accessibility are key to ensuring that wordmark is always visible. Please consider the colour of the background before selecting the appropriate wordmark or symbol colour.

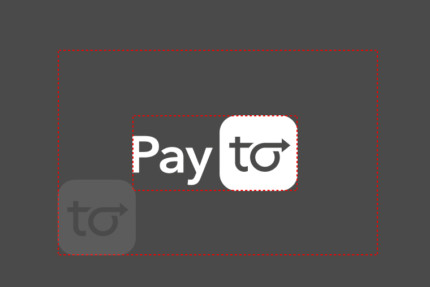

Legibility: clear space and size requirements - wordmark

For the minimum clear space, simply take the cube shape from the wordmark and add its dimensions around all edges. This is the minimum amount of space that you should give the wordmark to maintain legibility.

The size of the PayTo wordmark should be at least as large as every other payment mark or other mark displayed. It is recommended that the minimum size of the PayTo wordmark be no less than 60px wide in digital environments (or 20mm in print).

Legibility: clear space and size requirements - symbol

For the minimum clear space, simply take half the height of the cube shape and add its dimensions around all edges. This is the minimum amount of space that you should give the symbol to maintain legibility.

The size of the PayTo symbol should be at least as large as every other payment mark or other mark displayed. It is recommended that the minimum size of the PayTo symbol be no less than 25px wide in digital environments (or 10mm in print).

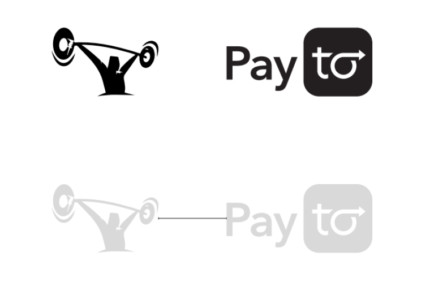

Co-branding

Co-branding principles should be used where a partner brandmark needs to have equal prominence and maintain its unique identity.

The PayTo wordmark can be positioned next to or above the partner brandmark whilst adhering to the clear space rule. There should be a relationship between either the width or the height of the two logos so there is equal positioning. One shouldn’t feel more important or larger than the other. When co-branding with a financial institution or merchant, the colour of the PayTo wordmark should always be within the PayTo core colour palette.

Communicating PayTo

Let your customers know PayTo is available with messaging across all customer touchpoints. These templates are not required to be used verbatim but using consistent themes will improve awareness and confidence in PayTo.

Please link back to www.payto.com.au/consumer where feasible to ensure customers have access to further information they may need about PayTo.

Short form templates

Short messages that can be used in-app, in text messages or at point of sale:

- You can now PayTo us, straight from your bank account.

- New! Use PayTo for secure payments directly from your bank account.

- PayTo us from your bank account.

- PayTo directly from your bank account.

- New! Direct debits are going digital. Welcome to PayTo.

Medium form templates

These short paragraphs are designed to support the development of your own communication material.

What is PayTo?

- PayTo is an easy, digital way to pay directly from your bank account. PayTo gives you visibility and control as you can see and manage your PayTo agreements in your internet or mobile banking app.

- PayTo is a fast and secure payment option. PayTo gives you more control over payments from your bank account with the ability to view and manage PayTo agreements in your internet or mobile banking.

Using PayTo:

- You can set up a PayTo agreement using your BSB and account number, or better still, your PayID which makes it easier to set up payments on the spot.

- With PayTo, you’ll have more visibility and control over your payment arrangements with a new, digital experience in your internet or mobile banking app.

- You can use PayTo for all kinds of payments including recurring bills that were typically paid through direct debit, or in-app and online purchases that previously relied on a card.

PayTo and direct debit:

- Direct debit is going digital. Welcome to PayTo, where you can view and manage your PayTo agreements in your internet or mobile banking app.

- When your direct debits move to PayTo, you’ll have move visibility and control. PayTo agreements can be viewed and managed in your internet or mobile banking.

Safety and security:

- PayTo agreements can be found in your internet or mobile banking app, so you can rest easy knowing that your information is protected by the same level of security as the rest of your banking data.

Long form templates - what is PayTo?

These longer paragraphs are designed to support developing your communication material when introducing PayTo.

- You can now pay directly from your bank account with PayTo <instead of using the current direct debit system OR needing a card>. It’s easy. Set up a PayTo agreement with us, approve it in your internet or mobile banking app and take the hassle out of payments. You can view and manage the PayTo agreement in your banking app, so you’ll have full visibility and control.

- We now offer PayTo – an easy, digital way to pay directly from your bank account. PayTo gives you visibility and control as you can see and manage your PayTo agreements in your internet or mobile banking app.

- PayTo offers you a secure and fast way to pay, directly from your bank account. When we set up a PayTo agreement with you, you can check and approve the payment terms in your internet or mobile banking app. Once we have your authorisation, we’ll debit your account in line with the agreed terms. If we need to make a change, we’ll ask for your authorisation again in your banking app. And, if you need to make a change, just get in touch with us.

Long form templates - using PayTo

These longer paragraphs are designed to support ‘how to use PayTo’ communications.

- To set up a PayTo agreement with you, we will need your BSB and account number, or better still, your PayID. Before we debit your account though, we will need your authorisation of the PayTo agreement. You can review the agreement’s detail and authorise it in your internet or mobile banking app.

- We are now offering PayTo as a secure and fast way to pay directly from your bank account. It’s a new option that allows payment without a card. We will set up a PayTo agreement with you, which details the payment terms. You’ll need to review and authorise it in your internet or mobile banking app.

PayTo terminology

These definitions may help you with communicating to customers so that consistent language is used through the PayTo journey.

- PayTo agreement: The agreement that records the authorised payment terms between us (the business or merchant) and you (the payer customer).

- Payment terms: The specific terms that collectively make up a PayTo agreement including:

- Payee or payment initiator: The party initiating or receiving the payment.

- Payment amount: Amount(s) authorised by the payer customer.

- Frequency: How often payments may be debited from the payer customer’s bank account.

- Agreement type: Type of agreement, for example, fixed or variable.

- First/ last payment due: Date on which the first/ last payment may be debited.

- Description/ short description: Long or short form description of the agreement.

- Start date/ end date: First and last date that the agreement may be used for initiating payments from the payer customer’s bank account.